| In-Network (PPO benefit) - You pay: | Out-of-Network (Non-PPO benefit)* - You pay: | |

|---|---|---|

| Preventive Care | Nothing for covered preventive screenings, immunizations and services | 35% of our allowance† |

| Physician Care | $25 for primary care | 35% of our allowance† |

| Virtual Doctor Visits by Teladoc® | $0 for first 2 visits | N/A |

| Urgent Care Center | Accidental Injury: $0 Medical Emergency: $30 copay | Accidental Injury: $0 Medical Emergency: 35% of our allowance† |

| Prescription Drugs | Preferred Retail Pharmacy: Tier 1 (Generics): $7.50 copay1 Tier 2 (Preferred brand): 30% of our allowance Tier 3 (Non-preferred brand): 50% of our allowance Tier 4 (Preferred specialty): 30% of our allowance Tier 5 (Non-preferred specialty): 30% of our allowance Mail Service Pharmacy: Tier 1 (Generics): $15 copay1 Tier 2 (Preferred brand): $90 copay Tier 3 (Non-preferred brand): $125 copay Specialty Pharmacy2: Tier 4 (Preferred specialty): $65 copay Tier 5 (Non-preferred specialty): $85 copay | Retail Pharmacy: 45% of our allowance Mail Service Pharmacy: Not covered Specialty Pharmacy: Not covered |

| Maternity Care | $0 copay | Pre-/postnatal professional care: 35% of our allowance† Inpatient hospital: $450 per admission copay for unlimited days, plus 35% of our allowance Outpatient facility care: 35% of our allowance† |

| Hospital Care | Inpatient (Precertification is required): $350 per admission Outpatient: 15% of our allowance† | Inpatient (Precertification is required): $450 per admission copay, plus 35% of our allowance Outpatient: 35% of our allowance† |

| Surgery | 15% of our allowance† | 35% of our allowance† |

| ER (accidental injury) | $0 within 72 hours | Nothing for covered services |

| ER (medical emergency) | 15% of our allowance† | 15% of our allowance† |

| Lab work (such as blood tests) | 15% of our allowance† | 35% of our allowance† |

| Diagnostic services (such as sleep studies, X-rays, CT scans) | 15% of our allowance† | 35% of our allowance† |

| Chiropractic Care | $25 per treatment; up to 12 visits per year | 35% of our allowance†; up to 12 visits per year |

| Dental Care | The difference between the fee schedule amount and the Maximum Allowable Charge (MAC) | 35% of our allowance† |

| Rewards Program | Earn $50 for completing the Blue Health Assessment.3 Earn up to $120 for completing three eligible Online Health Coach goals.3 | Earn $50 for completing the Blue Health Assessment.3 Earn up to $120 for completing three eligible Online Health Coach goals.3 Math problem solvingamc12. |

Blue Cross Medicare Advantage Choice Plus (PPO) H1666-006 is a 2021 Medicare Advantage Plan or Medicare Part-C plan by Blue Cross and Blue Shield of Texas available to residents in Texas. This plan includes additional Medicare prescription drug (Part-D) coverage. The Blue Cross Medicare Advantage Choice Plus (PPO) has a monthly premium of $0 and has an in-network Maximum Out-of-Pocket limit.

Blue Cross Blue Shield Mri Copay Providers

Bcbs Mri Cost

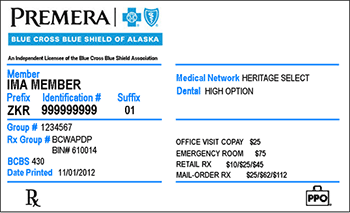

You may also have a copay after you pay your deductible, and when you owe coinsurance. Your Blue Cross ID card may list copays for some visits. You can also log in to your account, or register for one, on our website or using the mobile app to see your plan’s copays. Blue Cross & Blue Shield of Mississippi does not control such third party websites and is not responsible for the content, advice, products or services offered therein. Links to third party websites are provided for informational purposes only and by providing these links to third party websites, Blue Cross & Blue Shield of Mississippi does not.